Landlords are making a fortune. Or are they?

If you own property, the assumption is that you’re making a good living off the rent or

leases of the property that you own. Without considering all the factors of what

determines rental rates, it is easy to jump to such a conclusion.

However, aside from what the market itself will bear, there are many factors that

determine rental rates. The reality is, with all costs associated with property ownership,

there isn’t always a lot of revenue left over for property owners.

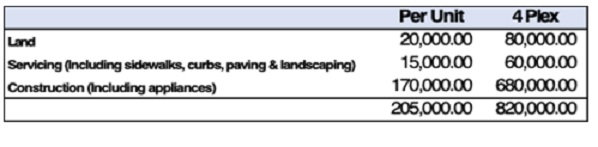

The cost of land, servicing, and construction itself is driving up the cost of new housing.This applies whether you are purchasing a new home or living in a newly constructed rental property.

For example, one of the most efficient ways to build family housing is to construct a four-plex, as you are able to get four units on one lot. The rough cost of building a new

four-plex (each unit having three-bedrooms) is approximately $205,000 per unit, with a

variance (either up or down) of five per cent:

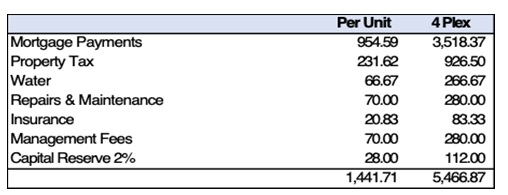

Assuming that investors use conventional financing with 25 per cent equity into the project this would mean taking out a mortgage of $615,000 on the four-plex. When amortized over 25 years, the monthly payments would be $3,518.37 (based on a 4.5 per cent interest rate) or $954.59 per unit.

In addition to building costs, there are many other costs as well. Some of the costs that are part of owning the property include having to pay property tax, water, and maintenance (this includes everything from garbage pickup, grass cutting and snow removal, repairs and, replacement of appliances).

Based on the value of $205,000 per unit, the monthly costs per unit look something like this:

These figures do not factor in a return for the investor or vacancies which run anywhere from one to three per cent each year. This also doesn’t factor in the shortfall if tenants don’t pay their rent.

Therefore, at a time of rising interest rates, for a new three-bedroom unit the rate will likely be set at $1,450 per month, just to break even. It should come as no surprise that as costs such as interest rates, property taxes and monthly water rates increase, so too will monthly rental rates increase.

Vionell Holdings Partnership (VHP) provides rental housing and property management for an array of residential and commercial customers, including Condominium Management. VHP currently has nearly 4,000 units under management in Manitoba. For more information please visit www.vhproperties.ca.

VHP has committed to constructing 128 multifamily residential units and 48 Life Lease Units in Portage la Prairie the first 48 units will be ready for occupancy in fall of 2019.

16

16